Photo by Miguel Henriques

Economics Education is Really Bad

By: Vijai Kumar

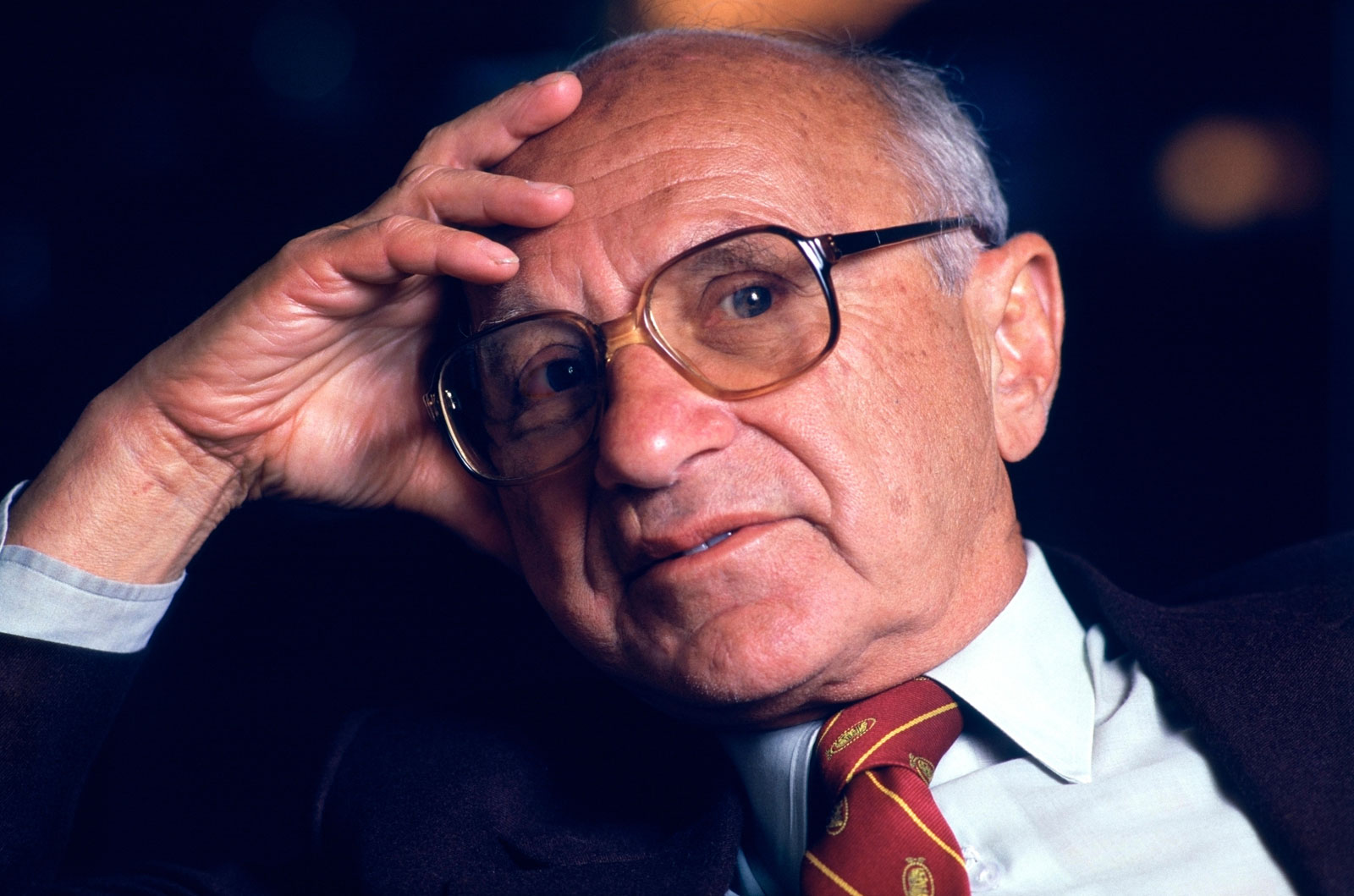

Economist Milton Friedman pictured above

When a student enters their first economics class at the undergraduate level, they are introduced to the basic relationship of supply and demand. From this point on, they learn laws and theorems the same way a physics student learns their respective axioms. The economics student is under the impression that their field of study is as aridly mathematical as the sciences. Upon graduation, they may enter a finance position, where their belief in the immutability of the market is further reinforced. “If x, then y, if y, then z”, economics language begins to resemble a Boolean formula, and the dismal science continues to conceal itself as an imposter in the STEM field.

What is missing from the economics discipline is the long history of economic debate. Approach an economics graduate and they will likely struggle to identify names like Leon Walras, Alfred Marshall, Karl Polanyi, and Hyman Minsky – all of whom have contributed to the ideas that they learned in school, while maintaining disagreement. They may be familiar with popular names like John Maynard Keynes and Milton Friedman because of their status in popular culture, and they would have probably heard of Adam Smith and David Ricardo but may struggle to articulate what they believed. Can you imagine a philosophy major learning about existentialism and not being able to name a single existentialist?

Yet, this is the case for economics. Ideas about how we define value have been hotly debated and continue to be contested to this day. Adam Smith and David Ricardo, often associated with free-market capitalism, operated in a time when the Labour Theory of Value reigned as the dominant paradigm for value creation, an idea most often attributed to Karl Marx. William Stanley Jevons kicked off the marginalist revolution, which purported that value is derive from individual preferences and the desire to maximize utility. This ushered in a new era of neoclassical economics, supposedly freeing economics from the limitation of “political economy” and transforming into a science. This claim, however, barely holds water as the debate about how we determine value, the role of the government, and the fallibility of the market, all remain to this day.

Financiers will have you believe that AOC-type socialists lack economic literacy, governments create inefficacies and deadweight loss, government spending is a precursor to hyperinflation, inflation is purely a function of the money supply, and so on. These are all ideological dicta disguising themselves as scientific fact. Economics education, as it stands, favours an understanding of supply and demand that would be mostly likely be taught at the Austrian or Chicago Schools, which some may call neoliberal. This version of economics is excessively technocratic. Purveyors of this perspective supposedly inure themselves from criticism by stating “ceteris paribus” – all things remaining equal – and that the fundamental assumption of economics are just assumptions. They say that it is helpful to look at effects within a vacuum so we can isolate reactions and behaviours. While this is true, it effectively creates epistemic arrogance. Viewing effects in a vacuum is useless when commenting on economic phenomena, which likely lends itself to the joke that you should believe the exact opposite of what an economist predicts. Distilling an event to its fundamental parts, to be observed in a vacuum, of course with the caveat ceteris paribus, should not vindicate one’s authority on the subject. Yet it almost always does.

Let us the take the fundamental assumption of the quantity theory of money (QTM), an idea every economics student becomes familiar with by the time they take their first macroeconomics class. The QTM states that the general price levels are directly a result of the money supply, or in other words, it assumes a direct causation between inflation and the amount of money (or currency) circulating in an economy. This has served as fodder for Monetarists a la Milton Friedman. We just have to look around and see a world in which there is unprecedented low inflation despite low interest rates, in many cases negative interest rates, and quantitative easing – de facto increases in the money supply.

This is to say nothing of Japan’s deflationary challenges, despite having the highest debt-to-GDP ratio in the world, or the cooperation between the Federal Reserve and the US government before, during, and after World War II. When considering all of the exceptions to the rule, we discover that the correlation between increases in the money supply and inflation is not 1-to-1. Abba Lerner, someone who is rarely discussed in the economics classroom, instead proposed the idea of “functional finance” which suggests that governments can increase the money supply to reach “full employment”, and it is only beyond full employment that we experience inflation. It is also important to consider how the increase in money supply is concentrated. Donald Trump’s $1.5 million tax cut evaded the Byrd Rule and was implemented despite not having a plan to “finance” the proposal. This is, in effect, an increase in the money supply. Monetarist likely ignored the fact that the tax cut did not result in higher inflation.

In other words, while inflation might involve an increase in the money supply, it does not necessitate it. As we learn in basic statistics, correlation does not equal causation. Inflation, like many other economic relationships, requires either an increase in demand or a decrease in supply. This view has created a generation of people who become suspicious at any attempt to increase the money supply. Libertarians never miss a day to criticize Trudeau’s supposed reckless spending, conjuring up frightening images of Venezuela’s hyperinflation. This is all rooted in the misunderstanding that is the QTM. It is no more than an unsubstantiated over-simplification of the economy, yet economics students are taught this as if it is fact.

I focus on QTM because it is the latest cock and bull story to receive mainstream attention in the COVID-19 pandemic. But there are no shortages of myths that pervade the economics classroom. The most fundamental macroeconomic indicator, GDP, is taught as a simple arithmetic formula that is the summation of consumption, government expenditure, investments, and net exports. What is left out of the classroom is just how politically fraught, historically controversial, and unbelievably precarious this metric actually is.

As recently as 2008, the System of National Accounts (SNA), the organization that provides recommendations on how to tabulate GDP, revised how financial services are incorporated into GDP, counting financial intermediation as final output. This means that by exploiting price changes in the stock market, one can provide the equivalent economic contribution of an entrepreneur, construction worker or health care provider. You may or may not agree with this view, but the way in which “value added” is calculated makes the issue more complicated.

For example, the SNA views government expenditure purely at the cost level (i.e. employee wages, etc.), and does not attribute any surplus “value creation” to the government, considering they do not generate profits like the private sector. State-owned enterprises, however, may operate at a profit, but the profits are counted within the industrial sector in which they operate. These accounting conventions therefore undervalue the government’s contribution to Gross Value Added (GVA) and create the impression that there is no way that the government can increase an economy’s productive output. The SNA’s calculations are not, by any stretch of the imagination, an objective and clinical arithmetic exercise. They are deeply ideological.

There are countless other examples of ways in which the economics education impoverishes students of a rich and necessary perspective when discussing this deeply fascinating discipline. Unfortunately, economics students do not learn history. In fact, as economics undergraduates advance in their learning, they focus more on the mathematical abstractions and even less on the historical and sociological insights of the field. This creates the impression that economics is more like physics and computer science and less like sociology and political science. In an attempt to create a neutral point of view to learn economics, we’ve washed away the history, the philosophy, the controversy, and in my opinion, what makes this discipline profound. At its core, economics is an exploration of human behaviour. The rise in popularity of behavioural economics gets at this point (something that is still treated as a fun elective rather than compulsory material at the undergraduate level). I argue not for the inclusion of specific perspectives and historians, but an entire rethinking of how this discipline is taught. Economics students deserve to be introduced to the panoply of ideas and contradictions economic history has to offer. It’s time we transcended ceteris paribus and started looking at the world mutatis mutandis, once necessary changes have been made.