Digital Taxes: A Fake Solution for a Real Problem

By: Nicola Bressan

“We’ve got to be talking about taxes. That’s it: taxes, taxes, taxes. All the rest is bullshit in my opinion.”

It is with these words that the Dutch historian Rutger Bregman, at the worldwide reunion of private jet users and caviar aficionados that is Davos’ World Economic Summit, addressed one of the most pressing challenges today’s policymakers have to face: tax avoidance. Eroding the depth of public resources, damaging the public’s faith in the system and causing tension between countries, the phenomenon has recently grown into one of crucial political and policy importance. But what does tax avoidance exactly mean? The OECD defines it as:

“A term that is difficult to define but which is generally used to describe the arrangement of a taxpayer's affairs that is intended to reduce his tax liability and that although the arrangement could be strictly legal it is usually in contradiction with the intent of the law it purports to follow.”

As this phrasing alludes to from the get-go, tax avoidance is indeed a concept whose boundaries are quite blurry, both for experts and particularly for the general public. Often mistaken with the more immediately comprehensible concept of tax evasion, the confusion surrounding what tax avoidance practically consists of is omnipresent in public debate. Like most things relating to policy, nuance is key: in the spectrum between a perfectly acceptable tax optimisation practice (such as, for example, the use of tax credits for research and development or green energy) and tax evasion (deliberate misreporting of revenue), tax avoidance measures lie somewhere in the grey middle area.

An Ever Growing Problem

For all practical intents and purposes, the term tax avoidance refers to the multitude of mechanisms put in place by multinational groups so as to move their profits from high-tax jurisdictions to jurisdictions with a lower imposition rate. To put it practically, in the most down-to-earth terms possible: you pretend that your profits were all made in places like Ireland or Luxembourg and that – magically – your subsidiaries in France, Italy or Germany barely make any profit. From sophisticated accounting schemes with creative names (the infamous “Double Irish with a Dutch Sandwich” and the “Single Malt” definitely stand out) to simpler loopholes allowing for artificially inflated transactions between subsidiaries of the same group, the various tools employed are complex and detailing them would go far beyond the scope of this article. What is interesting to note is how these practices have evolved over the years, both in terms of scope and public attention, from an obscure matter familiar only to the most daring of tax planners, to an issue that is front and centre in the policy agenda.

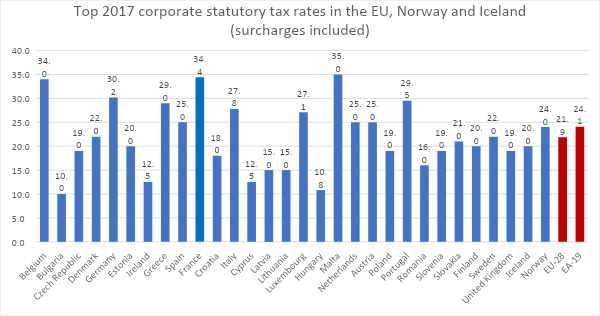

Taking a relatively cohesive bloc of countries such as the EU, it is easy to see how corporate tax rates can differ wildly, making the incentive for tax avoidance more than tangible. Chart Data: European Commission.

While by no means new – the first OECD report on the matter goes as far back as 1978 – worldwide corporate tax avoidance has grown into a 500 to 600 billion USD yearly hole in public budgets. This accounts for an astonishing 1% to 1.3% of the entire global GDP. Taking country-specific estimates, the evolution is staggering: the loss in revenue for the French government, for example, went from less than 1 billion EUR in year 2000, to 13 billion in 2008, and past 30 billion starting from 2013. This exponential growth can be easily explained by taking into account two phenomena of our generation: the acceleration of economic interdependence and the digitisation of our economies.

Structural Legal Challenges

If the former is self-explanatory, the latter isn’t. Among the multi-faceted challenges digitisation brings to our production models, democracies and daily lives, there is also that of taxation. The definition of what fair taxation is, as well as its enforcement, are matters that our connected and internet-reliant world makes even more difficult to answer. Traditional frameworks to determine taxable entities and their imposable amounts – which stem all the way back to the early 20th century – are hardly applicable to the modern production of added value and profits. It is as though we were trying to post pictures on Instagram with a 100-year-old telegraph.

One of the most basic of concepts in our tax jurisdictions, the idea of a ‘permanent establishment’, is largely inapplicable to the digital economy. If generally, taxing rights are computed from the profit collected from a fixed presence within a given territory, the business model of most tech and digitally-oriented conglomerates can generate great amounts of revenue with little to no actual physical presence in a country. Defining a ‘nexus’, or a taxable presence within a country, therefore becomes far more complicated once profit is largely disconnected with physical presence in a jurisdiction.

Secondly, the intangible nature of the goods and services sold makes it so that defining value creation, and even more importantly linking value creation to tax regimes, is challenging. As Olbert and Spengel (2017) put it, taking the usage of user data as a marketable good as an example, if “the concept of data as a contributor to value creation is established, the question of how to attribute value to the generation, storage and use of data is still unanswered.” In laymen’s terms: if a Brazilian user by willingly sharing his data creates value for an American platform, shouldn’t that be taken into account in the calculation of owed tax? With this in mind, the usual principle of arms-length transactions and the current transfer-pricing models used to allocate taxable profits within value chains fall short of effectively capturing and appropriately taxing the new, digitalised ways to produce added value.

As these examples show, the phenomenon of tax avoidance is, in effect, exacerbated by the digital economy. While crucial, they are by no means the only causes contributing to making digitisation a factor of aggravation: abuses of VAT exemptions, the hardship in ‘characterisation of income’ (many e-commerce transactions may, for instance, be classified as royalties), the heavy reliance on R&D cost subsidies and the advantageous criteria for depreciation specific to digital business models also figure on the list. This discrepancy is one that companies in the sector do not fail to capitalise on: if on average, Small and Medium-sized enterprises in Europe are taxed at an implicit corporate tax rate of 23%, the largest companies of the digital sector only pay an effective corporate tax rate of 9% (PwC and ZEW, 2018). Beyond the ethical concerns and the missing governmental revenue tax avoidance brings forth, the disloyal competition is an aspect that should not be overlooked.

The relative failure of international policy initiatives

The growing awareness of this injustice has, slowly but surely, translated into a growing policy interest to the matter. From an international point of view, the most relevant initiative tackling the issue is the OECD’s ‘Addressing Base Erosion and Profit Shifting’(BEPS) 2013 document and its ensuing Action Plan, finalised in 2015. With the cooperation of 135 countries on the project (albeit to a varying degree of involvement), and around 85 countries - representing more than 90% of world GDP - having signed the Multilateral Instrument on BEPS, the project is widely seen as a successful soft law endeavour. It has been instrumental in setting a concrete worldwide benchmark, and bringing the topic to the forefront of international cooperation. It’s greatest achievement is, arguably, having established universally recognised definitions of Controlled Foreign Company rules, Permanent Establishment status and alignment of transfer pricing criteria to value creation. However, with the process being largely consensus-based, and having the explicit aim of being flexible and practical enough to be implemented rapidly in vastly different jurisdictions and tax regimes, it is not a silver bullet framework. In fact, this first truly global initiative on the matter should be viewed as the groundwork for fighting tax avoidance upon which to build further, rather than ‘the final destination of international tax law reform’ (Reuner and Xu, 2019).

More directly relevant and impactful to the topic of digital taxation are the recent initiatives contained in what has generally been dubbed ‘BEPS 2.0’. Consisting of two pillars, they aim to solve at the root the specific challenges of the digitalization of the economy discussed earlier: on the one hand, the solving of the territorial and nexus-related issues that plague digital services taxation rights, and on the other the establishment of a minimum global corporate tax rate as well as of a tax on base-eroding payments. Both of these areas have the potential to significantly disrupt long-standing paradigms in taxation processes, as well as de facto impacting the level of sovereignty that individual jurisdictions have in setting their effective corporate tax rates. Depending on where the minimum tax is set, some low-tax jurisdiction such as Hungary or Ireland might see companies legally resident within their territory being taxed above the threshold set by their own legislators, where its foreign subsidiaries’ profits were taxed below the OECD set minimum rate. Similarly, there is significant technical difficulty and high sensitivity linked to choosing the proper means of allocating taxable profits on the basis of where digital services are consumed, rather than where permanent establishments are located. As a result, the negotiations on the guidelines to be adopted globally have been fraught with political contrasts and vested interests, which have slowed down the negotiations to a screeching halt. While initially meant to be completed ‘before the end of 2020’ (G20, 2019), the initiative is still far from having reached a final stage, with the US Treasury secretary Steven Mnuchin having announced on June 17, 2020 that the talks had ‘reached an impasse’ . The position of the new Biden administration is still unclear. While most parties maintain officially that the global option through the OECD is the preferred forum for addressing this issue , more and more jurisdictions have turned towards unilateral solutions. Yet, if the old-as-time adage of ‘something is better than nothing’ is a truth to live by generally, this does not apply to policy: as seen below, poorly crafted digital taxation risks doing more harm than good.

The Proliferation of Digital Services Taxes

These interim solutions have been mostly centred around one typology: digital services taxes (DSTs). Computed on revenues instead of profits, these measures circumvent one of the most crucial of issues plaguing tax avoidance: as revenues are generally harder to underreport without falling into the scope of blatant tax evasion, levies based on pre-VAT gross turnover would manage to capture a higher share of the actual value created in a given jurisdiction. However, this is only partly applicable to the digital economy. 16 countries have either already implemented or announced to be planning to adopt such revenue-based taxes. The policy convergence in the field, while not absolute, has been noticeable since France’s 2019 ‘Taxe GAFA’ (GAFA being an acronym for Google, Amazon, Facebook and Apple, which should already provide us with a hint of the aimed targets of the initiative) spearheaded the worldwide wave of adoption of digital services taxes. While not being the first country to have enacted a specific taxation measure addressing the imbalances in imposition of large digital groups - for example, Italy had adopted (but never implemented) a digital transaction tax in 2017, and India has been imposing an equalization levy on non-resident service providers ever since 2016 – France and its tax have had a significant role in establishing a model and a benchmark for what today would be called a fully-fledged DSTs. It has done this by pushing jurisdictions into accepting DSTs as the tool of choice to tackle these disparities, and in imposing many of its mechanisms as the common pre-OECD consensus policy reference on the matter.

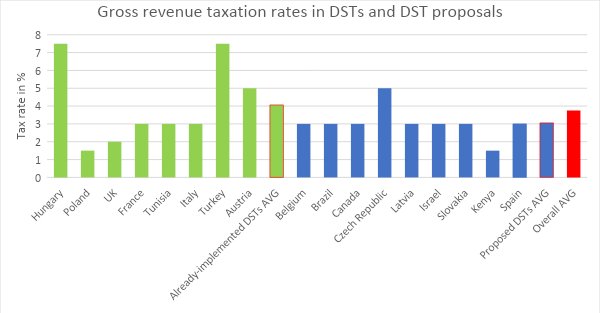

While not entirely convergent, we can see that the majority of jurisdictions having implemented or having declared to be planning to implement a DST have opted for a rate hovering around 3%. The similarities do not stop there: they also concern the applicable thresholds and, to a lesser extent, the absence of sunset clauses and the definition of imposable services.

An analysis of the divisive measure, which ever since its adoption by the French Parliament has become the spark of a transatlantic trade dispute, is necessary so as to understand its concrete implications. The French example serves as an important case study for the rationale and application of Digital Services Taxes. Firstly, it is aimed towards digital interfaces allowing users to enter in contact with each other with the goal of selling goods and services, and targeted advertisement services mobilizing user data. This delimitation of the taxable services falling under the imposable base of the tax is more than relevant, as it excludes some digital companies (or big MNE companies who source a significant yet not majoritarian part of their income digitally) whose business models do not revolve around these two services: among these, for example, cloud computing, direct provision of intangible content, non-targeted advertisements. Companies like Spotify or Netflix, for example, whose business models do not have an intermediation element, and rely mainly on subscriptions for revenue, are not liable to pay the tax. Furthermore, it leaves out some parts of the business ventures of the very companies targeted by the tax itself: in fact Apple and Amazon have a large subset of their revenues which do not fall under the criteria above, either because they are offline sources of income (Apple’s hardware sales being an example) or because they are neither based on targeted publicity nor on intermediation (Amazon’s cloud computing services, for instance).

Secondly, so as to establish which companies fall within the scope of the DST, the criteria are twofold and both based on the yearly revenue of the services mentioned above: the company has to exceed 750 million EUR of worldwide targeted services’ revenue, and 25 million EUR of targeted services’ revenue in France. The obvious goal of these measures is to limit the tax to large multinationals, partly because they are responsible for the highest share of tax avoidance eroding French taxes, and partly to compensate for the network effects and returns to scale they enjoy over their smaller competitors in a market that is characteristically oligopolistic. Potentially distortionary, it could be argued that this limitation to companies above an arbitrary threshold leads to differentiated treatment, directly contrary to the principle of tax neutrality. A similar criticism encountered is the one decrying the arbitrary nature of the lofty threshold chosen, which many have interpreted as being deliberately set so high so as to carve out European and French companies from the imposable criteria, but being formally compliant with non-discrimination principles in WTO, OECD and EU rules. According to governmental and third-party estimates, the number of imposable companies would range from 30 to 40, out of which the only wholly French-owned company would be Criteo. The face burden of this tax levied would be borne mostly by US-based companies, who in the latter of these estimates comprise as much as 17 companies of the 26 listed.

The Ineffectiveness of Digital Services Taxes : The Google Case Study

Finally, on the means of calculation of the tax itself: even when deliberately disregarding the widely documented distortionary effects of revenue-based taxation, the limited effectiveness of these measures are evident. The chosen rate of 3% on revenues, while higher than most other gross receipt taxes (in the USA for instance, 7 states have gross receipts taxes on the totality of transactions, with statutory rates going from 0.02% in Tennessee to a maximum 1.95% in Delaware), is by no means enough to compensate for the discrepancy tax avoidance brings to the table. This is evident even from a superficial look at the revenue created by the tax – in the fiscal year 2019, the French government has only collected a mere 350 million EUR –. Providing a concrete example here would help in better visualising the minimal effect of the tax on the profitability of the firms.

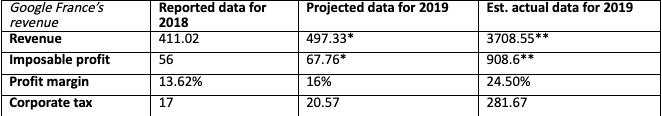

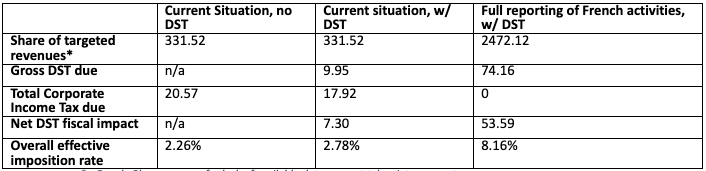

*= actual data not available at the time of calculation. Estimated by applying global growth factors to 2018 data. **= estimated by cross-referencing industry and web analytics data.

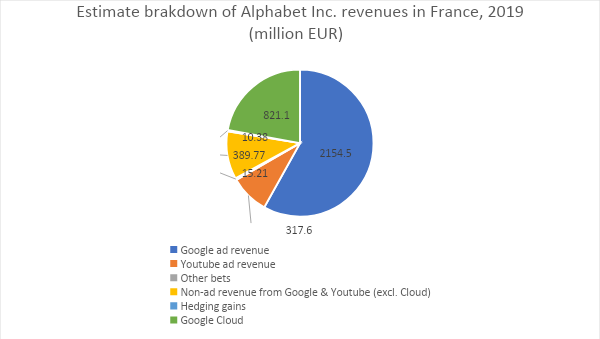

As we can see from the estimate above, basing the analysis on market shares, realistic growth factors and the worldwide revenues reported by Alphabet Inc. for the fiscal year of 2019, it is possible to estimate Google France’s 2019 revenue to be around when 3708.5 million EUR - seven times higher than the amount that we can reliably presume Google to have actually reported to the French authorities. Its breakdown would be the following, with only around 68.7% of its activities (Youtube and Google’s ad revenue) falling under the scope of the digital services tax.

Note: the calculations for ‘Hedging gains’, ‘Other bets’ and ‘Non-ad revenue from Google & Youtube (excl. Cloud) are estimated by holding constant the global proportion of revenues.

More importantly still, the actual impact of the DST would really only marginally assist in making Google’s actual imposition rate fairer and closer to France’s 31% corporate tax rate. Computing the amount of corporate tax actually paid to the theoretical imposable profits, the result is an estimated effective imposition rate of 2.26%. The total amount of ad revenues Alphabet receives is 2472.1 million EUR, and the potentially due DST amount is 74.16 million EUR. This tax amount is insufficient to adequately compensate the gap with the corporate tax that, basing ourselves off of our prior estimate, ought to be paid in France in the first place. That effective imposition rate, considering that the DST is deductible from corporate income tax, would in fact be 8.16%. Ironically, Google France would be artificially in deficit for the year, the amount of due DST tax being higher than the net revenues declared so far. Claiming to be solving the issue of digital tax avoidance with a DST is tantamount to saying that a water gun is the way to solve the problem of your house burning down.

*= Google Play revenues, for lack of available data, are not taken into account.

Furthermore, this extreme scenario would apply only in the case where the totality of revenues stemming from French users were declared by Google as having originated in France. A case that, considering that the due tax will be calculated based on the yearly VAT reports submitted to French authorities, is highly unlikely. Without more structural reforms of taxation regimes, applicable tools relevant to characterization of income and linkage of digital revenue sources to one jurisdiction would remain largely insufficient to legally pin down owed tax. And needless to say, Google is unlikely to voluntarily start declaring the totality of its income in a 31% CIT (soon to be 25%) jurisdiction. More realistically in fact, the actual impact of the tax would resemble the second column more closely, with a constant amount of reported French revenues. The ineffectiveness of the tax here is even clearer: far from a deus ex machina solution, the net fiscal impact of the DST is 7.3 million EUR for a subsidiary we can realistically estimate to be earning 3708.6 million EUR a year in revenues. Coming back to the burning house metaphor: we need a fire hose, now.

Digital Services Taxes: An Insufficient Solution Across the Board

While this rapid overview is by no means exhaustive, it is sufficient to get a glimpse of why unilateral initiatives to solve tax avoidance fall short of the mark. The issues start from the point of applicability: from the distortionary effects of gross revenue-based taxation, to the incompatibility with long-established international taxation principles, all the way to the seemingly unfair targeting of foreign companies and the plausible contrasts with privacy regulation. They end with concerns of effectiveness and efficiency. Among the further concerns marring the viability of such taxes, we can note the minor amount of revenue netted, the extensive unintended economic costs, from pass-on costs of the tax to compliance costs and distorted incentives, and finally the significant implementation efforts burdening public administrations.

At best, these initiatives are a catalyst for international talks, a means to flex policy muscles and a bargaining chip at the international negotiating table. Judging by the speed of current OECD negotiations, this view could be dubbed as optimistic. At worst, the French and other DSTs are bound to primarily serve as a political tool for distraction and short-term gain, rather than the concrete solution they are often portrayed to be. Real solutions to the tax avoidance and advantageous taxation digital supergroups enjoy can only be international and structural, updating practices of international taxation that have now become obsolete. They cannot be a mere quick fix. Voters demand it, the sustainability of our economic models requires it. Recalcitrant countries, as well as the very groups targeted by these insufficient measures need to understand it: they have got to be talking about taxes. Refusing to sit at the table and stifling progress towards consensus will no longer be enough , as policymakers and citizens start escalating pressure for change. The cost of the proliferation of sub-optimal measures such as the Taxe GAFA risks being massive for all stakeholders involved.

The world deserves better. Structural reform is as urgent as ever. The sustainability of our systems depends on it. As Bregman himself would put it: “All the rest is bullshit”.

Nicola Bressan is a public affairs consultant from Italy. An alumnus of Bocconi and Sciences Po, he is passionate about policy, economics, the European Union, chess and Inter Milan. He will gladly accept any debate on current and less current affairs, as long as it does not concern cream on carbonara or pineapples on pizza.